Description of the calculation methodology

General

All performances are based on a reinvestment of the dividends and - unless otherwise stated - on an investment amount of EUR 1,000.00. Unless stated otherwise, these are gross value developments (calculation according to the BVI method). With the savings plan, the monthly payments - unless otherwise stated - are invested with an investment amount of EUR 50 at the redemption price. Performances are past performance.

Net performance:

In addition to all costs incurred in the fund, the relevant front-end load is also taken into account, which the investor has to pay at the beginning of the performance period shown here, as well as any redemption fee that may be incurred (see "Fund profile"). Any deposit fee that may be incurred and reduce performance is not taken into account.

Gross performance:

Corresponds to the net performance, but does not take into account the front-end load and any redemption fee that may apply.

BVI method

Procedure for calculating the performance of a fund, which is used by the association of the fund industry, the BVI Federal Association of German Investment Companies. The distribution is reinvested and the costs of the investment such as front-end loads, redemption fees, custody fees or account management fees are not taken into account. The performance of a fund calculated in this way does not usually correspond to the actual investment result, but allows the management performance of different funds with a similar investment focus to be compared without being distorted by the fee structure.

In our sample calculations and charts, the performance of the one-off investment is calculated using this method.

Historical performances

Calculation of a single investment in percent

The determination of the percentage performance of an individual investment is based on the redemption price and thus the front-end load is dispensed with in favor of a uniform presentation. Any distribution or accumulation during the period will be taken into account. The performance is calculated according to the specifications of the BVI: “The performance of a one-time investment is calculated on the basis of the unit values. The unit value of a fund is calculated from all assets (net asset value) - including all income (e.g. interest, dividends, rent) and taking into account costs (e.g. management fee) of the fund - divided by the number of units issued. "

Source: www.bvi.de

Calculation of a single investment in euros

The determination of the percentage performance of an individual investment is based on the redemption price and thus the front-end load is dispensed with in favor of a uniform presentation. Any distribution or accumulation during the period will be taken into account. First, the percentage performance of a fund is calculated for a given period (see above) and then the final amount is calculated by compounding.

Calculation of a savings plan in percent

To determine the percentage performance of an individual investment, the NAV (Net Asset Value) is used as a basis and the issue surcharge is therefore dispensed with in favor of a uniform presentation. Any distribution or accumulation during the period will be taken into account. Shares in a fund are purchased on the first trading day of the month in the amount of the savings deposit. Selling date is the last trading day of the last fully completed month of a time period. In the event of a distribution or accumulation, the corresponding number of units in the respective fund are acquired at the applicable NAV on the reinvestment date. This process is repeated until the last trading day of the previous month of a time period is reached. On the last trading day of the previous month, the shares acquired up to that point are sold at the valid NAV. The difference between the nominally paid-in savings deposits (at 50 euros per month this results in 600 euros for the period of 1 year) and the actual equivalent value at the time of the day indicates the increase or decrease in value in euros. In order to determine the percentage change in value, an interest rate is determined iteratively, with which all deposits earn interest according to their investment period and the cumulative result corresponds to the effective final amount in euros. This interest rate then represents the performance of the savings plan.

Calculation of a savings plan in euros

To determine the percentage performance of an individual investment, the NAV (Net Asset Value) is used and the front-end load is therefore dispensed with in favor of a uniform presentation. Any distribution or accumulation during the period will be taken into account. Shares in a fund are purchased on the first trading day of the month in the amount of the savings deposit. Sale date is the last trading day of the last fully completed month of a time period. In the event of a distribution or accumulation, the corresponding number of units in the respective fund are acquired at the applicable NAV on the reinvestment date. This process is repeated until the last trading day of the previous month of a time period is reached. On the last trading day of the previous month, the shares acquired up to that point are sold at the valid NAV. The difference between the nominally paid-in savings deposits (at 50 euros per month this results in 600 euros for the period of 1 year) and the actual equivalent value at the time of the day indicates the increase or decrease in value in euros.

Calculation of future performance

Calculation of a single investment

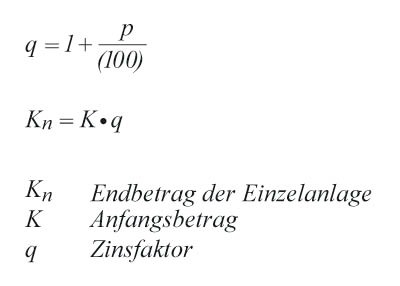

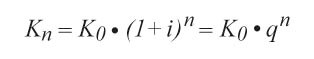

To determine the increase in value measured in euros, a freely selectable interest rate is used for an individual investment. The running time is also variable and freely definable. The front-end load is preset when selecting a fund and corresponds to the currently valid front-end load. If no fund is selected, the issue surcharge can be entered as an option, otherwise it will not be taken into account. The calculation is based on the compound interest formula.

If an issue surcharge is expected, the investment amount will be increased before interest is paid just this reduced.

Calculation of a savings plan

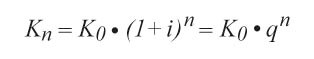

To determine the increase in value measured in euros, a savings plan is calculated with a freely selectable interest rate. The running time is also variable and freely definable. The front-end load is preset when selecting a fund and corresponds to the currently valid front-end load. If no fund is selected, the issue surcharge can be entered optionally, otherwise it will not be taken into account. To determine the increase in value measured in euros for a savings plan, the individual investment amounts - analogous to the individual investment - are calculated separately according to their different lengths of term using the following formula.

The individual results are accumulated and the resulting final result represents the final amount in euros.

Calculation of a single investment in combination with a savings plan

To determine the increase in value measured in euros, a freely selectable interest rate is used for an individual investment in combination with a savings plan. The running time is also variable and freely definable. The front-end load is preset when selecting a fund and corresponds to the currently valid front-end load. If no fund is selected, the issue surcharge can be entered as an option, otherwise it will not be taken into account. The calculation for the individual system is analogous to the description "Calculation of a single system". The savings plan is calculated in the same way as described in "Calculation of a savings plan". The two resulting results are added and output as the final result.

Calculation of a withdrawal plan with capital preservation

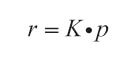

In order to determine the regular amount to be paid out in euros, a freely selectable interest rate is used in a withdrawal plan with capital preservation. The term is infinite, since the invested capital is not touched. The front-end load is preset when selecting a fund and corresponds to the currently valid front-end load. If no fund is selected, the issue surcharge can be entered as an option, otherwise it will not be taken into account. In addition, a one-year waiting period can be selected. The payment date is then postponed by this one year. This option offers the investor the opportunity to counteract the capital reduction caused by the deduction of the initial charge. The calculation for a capital preservation withdrawal plan is based on the “perpetuity” formula. A perpetual annuity is an annuity that can be paid from the interest income of a fixed income investment without changing the amount of capital invested:

Where r is the annuity to be paid repeatedly, K is the initial capital and p is the discount rate.

Calculation of a withdrawal plan without capital preservation

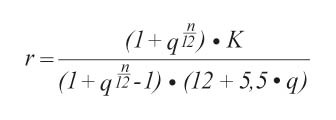

In order to determine the regular amount to be paid out in euros, a freely selectable interest rate is used in a withdrawal plan without capital preservation. The running time is also variable and freely definable. The front-end load is preset when selecting a fund and corresponds to the currently valid front-end load. If no fund is selected, the issue surcharge can be entered as an option, otherwise it will not be taken into account. In addition, a one-year waiting period can be selected. The payment date is then postponed by this one year. This option offers the investor the opportunity to counteract the capital reduction caused by the deduction of the initial charge. The calculation for a withdrawal plan without capital preservation is based on the following formula:

In contrast to the formula of "perpetual annuity", in the case of a withdrawal plan without capital preservation, it must be taken into account that the capital is completely used up after a certain period of time.